| |

Mr. Creosote is a fictional character who appears in Monty Python's The Meaning of

Life. He is a monstrously obese and rude restaurant patron who is served a vast amount of food and alcohol whilst

vomiting repeatedly. After being persuaded to eat an after-dinner mint – "It's only wafer-thin" – he graphically explodes.

The sequence opens the film's segment titled "Part VI:

The Autumn Years".[1]

President Joe Biden likes to pass himself off as a deficit slayer, which is a bit like Monty

Python’s Mr. Creosote claiming to be an avid dieter.

Biden in February of 2023 bragged that he had presided over “the largest deficit reduction in

American history,” a drop of more than $1.7 trillion. Never mind that the administration was still sitting on $1.4 trillion

in red ink when the president thumped his chest. In fact, the steep drop in the annual deficit was a result of pandemic

relief spending coming off the books and had nothing to do with the White House.

Biden did indeed happen to be the man sitting in the Oval Office when the deficit inevitably eased

after the nation’s battle with COVID. The president’s braggadocio, however, implies that he’s the leader taxpayers can trust

to get the nation’s fiscal house in order. And this is where reality intrudes.

Thanks to the massive spending bills backed by congressional Democrats and Biden, the baseline

trajectory of federal outlays over the next decade will be trillions of dollars higher than it would have been otherwise.

According to revised numbers from the Congressional Budget Office (CBO), “The estimated increase in federal outlays over

10 years was $18.76 trillion more than estimated only two years earlier,” the Wall Street Journal noted.

The CBO’s projections, in the wake of the Democrats’ spending spree, foresee annual budget deficits

continuing to climb as a share of the economy, with the national debt hitting 110% of gross domestic product (GEP) by

2030.

To make matters worse, inflation triggered by this administration’s recklessness will increase debt

payments, making it even more difficult to dig out of this abyss.

The president’s yearly budget blueprint has “deficit reduction” front and center for obvious

political reasons. Yet Biden’s sole plan to balance the books is to raise taxes on the dastardly rich.

So, Congress can continue to mainline other people’s money since Biden wants large tax hikes on

those making more than $400,000 a year. Contrary to Democratic talking points, the tax code is already highly

progressive, with the top 10% of earners accounting for 74% of all federal income tax collections. The president’s

tax agenda will be a drag on economic growth, making it more difficult to attack the debt.

Budget restraint may be out of fashion in today’s Washington, but congressional Republicans should

show some courage and reclaim the mantle of fiscal sanity by presenting taxpayers with an alternative spending plan. It’s

long past time that gluttonous Beltway politicians backed away from the trough, lest the nation’s finances suffer the same

disastrous fate that awaited Mr. Creosote.[2]

The harmful effects of excessive government spending have become the most pressing issue for

Americans due to the worst inflation surge in decades. Washington’s reckless choice to pump trillions of dollars

into the economy is the reason we face more inflation than other top economies around the world. Yet, incredibly, Congress

is still planning an onslaught of additional inflationary spending bills with seemingly no end in sight.

A more accurate way to see whether Biden has been good for the nation’s financial health is to

compare where things stood when he took office with where they stand today. The comparison makes it clear: Biden has

repeatedly chosen to make things worse.

Compared to projections from February 2021, when Biden had just taken office, a recent analysis

showed a combined $2.77 trillion in additional deficits over the 2021-2031 period. The largest factor for this increase was

the wasteful and opportunistic $1.9 trillion COVID-19 package that passed with exclusively Democratic support in March 2021.

The shoddy $1.2 trillion infrastructure bill that Biden championed added even more red ink.

Incredibly, things could have been even worse if any version of Biden’s disastrous Build Back

Better

multitrillion-dollar debacle had become law. Despite the false spin from leading Democrats, it would have led to

significantly higher deficits over the first several years, pouring more gasoline on the inflationary fire.

Biden’s 2023 budget plan is similarly bankrupt, with more inflationary spending; anti-growth tax hikes;

and radical, left-wing policy goals. It’s clear that the administration isn’t even considering the idea that now is

the time to rein in out-of-control spending.

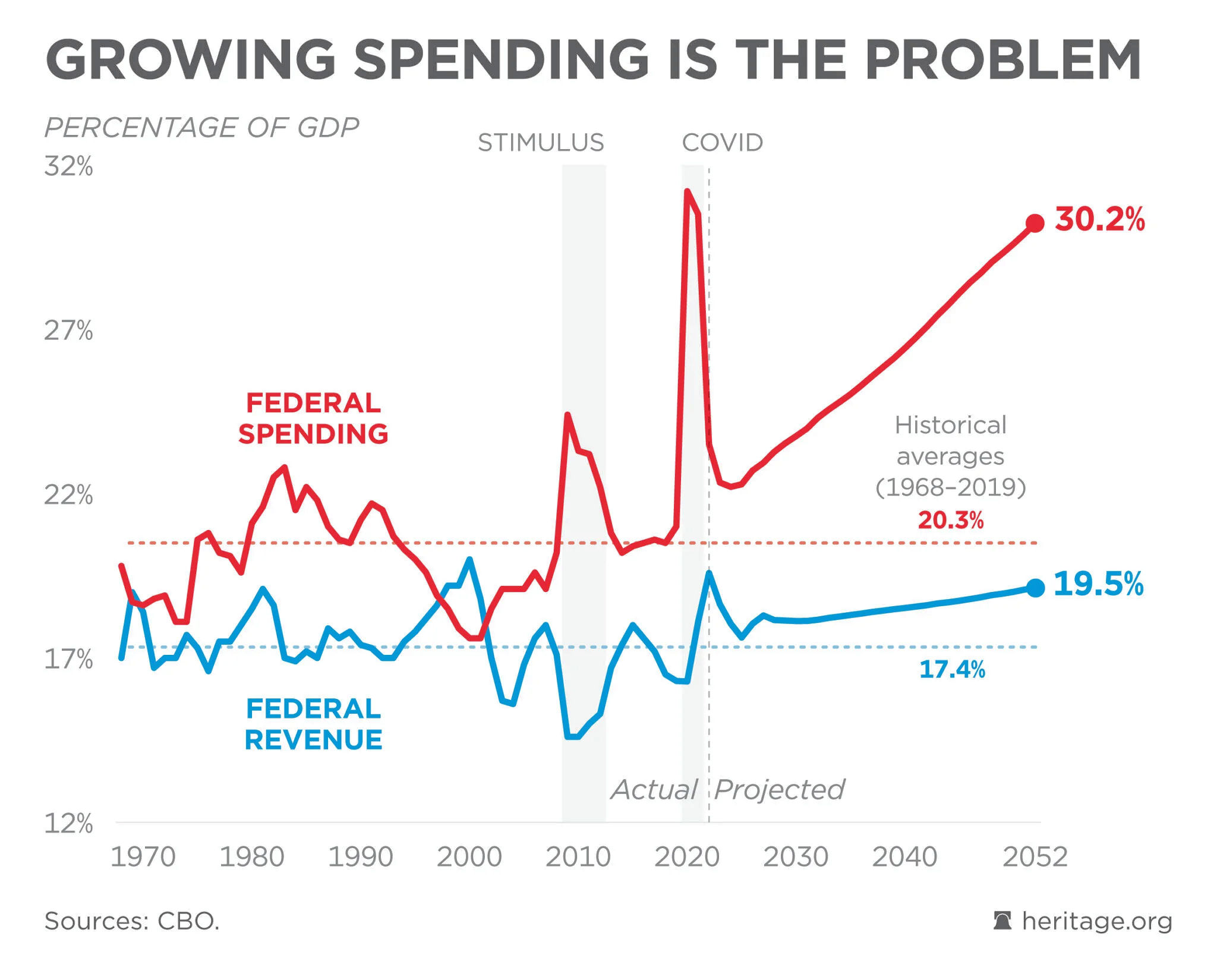

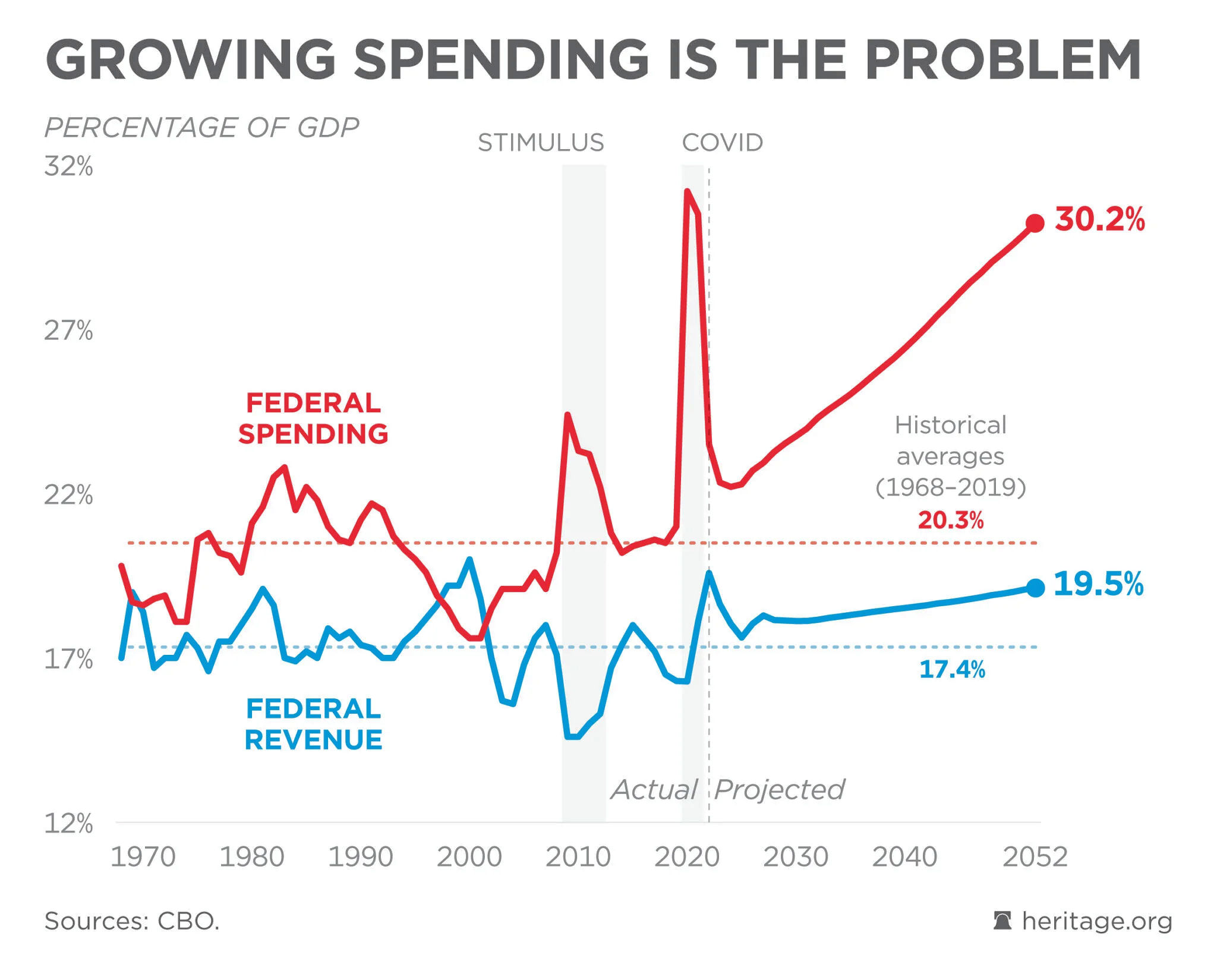

While the activist left claims that deficits are the result of taxes being too low, the reality is

that the IRS has been raking in record hauls after the passage of the 2017 tax cuts. In addition, the CBO’s long-term

projection makes it clear that we’re on the wrong path due to ever-increasing spending, not because Uncle Sam is taking it

easy on taxpayers.

The Grand Canyon-sized gulf between federal spending and revenues means that the

record-setting deficits seen at the height of the COVID-19 pandemic will eventually return if we continue with the government

and its fiscal policies that we have today.

The mounting deficits would have a twofold effect. First, they would mean that inflation would become

a much more enduring threat than the Biden administration would have you believe, since large federal deficits financed by

the Federal Reserve are inherently inflationary. Second, as the national debt continues to grow, the cost of just paying the

ever-increasing interest on that debt threatens to become another anchor around our necks.

The break-neck speed at which Washington’s spending has added to the national debt can’t be

sustained. Any adult who ran a household similarly to the way our government has been operating would be rightly scolded

for not examining his spending patterns, yet Congress and various special interests feel entitled to big annual spending

increases and “emergency” bailouts. Capitol Hill puts pork-barrel politics ahead of responsible governing.

Washington has proven over and over that it will choose the political expediency of debt and deficits rather than the sober

work of serious budgeting.

The irresponsible way that Congress and the Biden administration treat the nation’s finances is

nothing new, and it’s abundantly clear that the left views government spending as the answer to seemingly every problem

under the sun.

Only sustained pressure from the American public can change Washington’s broken and dysfunctional

internal culture. Our children’s future depends on it.[3]

February has historically been a big budget deficit month, but the Biden administration in 2023 still

managed to overachieve and run the second-largest February deficit ever. The only time the US government has run a February

deficit bigger than the $262.4 billion shortfall last month (February 2023) was in February 2021 in the midst of the COVID

stimulus.

This raises an important question: between a budding financial crisis and a US government spending

problem, how is the Federal Reserve ever going to get price inflation back to its mythical 2% target?

According a Monthly Treasury Statement (March 2023), the fiscal 2023 budget deficit stood at $722.6

billion. That’s a 51.9% increase over the deficit at the same point in fiscal 2022. In March of 2023, we were not

even halfway through the fiscal year and we were already knocking on the door of a $1 trillion deficit.

The US government was being hit with a double-whammy: falling revenues and increased spending.

Through the first five months of fiscal 2023, tax receipts and other federal revenues were down 3.9% while spending was up

7.7%.

In February 2023, the federal government reported receipts of $262.1 billion. That was down nearly

50% from the previous month and a 9.6% drop in revenue year on year.

There was clearly a shift in federal receipts. The federal government enjoyed a revenue windfall in

fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office (CBO) data, federal tax

collections

were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it

wouldn’t last. And government tax revenue will decline even faster if the economy spins into a recession.

But the real problem is on the spending side of the ledger. The Biden administration is

blowing through roughly a half-trillion dollars every single month. In February 2023, the US government spent $524.5 billion.

That was up nearly $38 billion from January.

And there is no indication that the spending freight train will slow down any time soon. Congress

passed a $1.7 trillion omnibus spending bill for 2023 that increased outlays by about $1.5 billion over fiscal 2022.

That is only one component of federal expenditures. The US government is still handing out COVID

stimulus money, and in March 2021, Congress approved $1.9 trillion in spending to address the pandemic. In 2022, it passed

the euphemistically named “Inflation Reduction Act.” Meanwhile, the US continued to shower money on Ukraine and other

countries around the world. All of that spending will pile on top of this most recent allocation of funding.

Meanwhile, the Federal Reserve raised interest rates by another 25 basis points in February of 2023.

That will add to the quickly ballooning interest cost.

According to an analysis by the New York Times, net interest costs rose by 41% in 2022.

According to the Peterson Foundation, the jump in interest expense was larger than the biggest increase in

interest costs in any single fiscal year, dating back to 1962.

According to the National Debt Clock, the debt-to-GDP ratio stands at 120.4%. Despite the lack of

concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that

a debt-to-GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now,

worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” so popular

on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for

$94,490 in order to pay off the national debt.

The soaring national debt and the US government’s spending addiction are big problems for the

Federal Reserve as it battles price inflation.

As we’ve seen, the push to raise interest rates is putting a strain on Uncle Sam’s borrowing costs.

But there is an even bigger problem. The Fed can’t slay monetary inflation - the cause of price inflation - with rate cuts

alone. The US government also needs to cut spending.

The US government can’t keep borrowing and spending without the Fed monetizing the debt. It needs

the central bank to buy Treasuries to prop up demand. Without the Fed’s intervention in the bond market, prices will tank,

driving interest rates on US debt even higher.

Something has to give. The Fed can’t simultaneously fight inflation and prop up Uncle Sam’s spending

spree. Either the government will have to cut spending or the Fed will eventually have to go back to creating money out of

thin air in order to monetize the debt.[4]

For many Americans, the debt that Congress racks up year after year seems like a faraway problem,

both in distance from Washington and years in the future. However, the ferocious growth of the national debt monster

is likely to consume us all sooner rather than later.

In an attempt to rein in the growing federal deficit, there have been promises by the Democratic

administration of steep new taxes along with onerous regulations that would kill the financial and energy gains of recent years.

Democrats would pair this tremendous spending with an almost guaranteed recession. Considering that the last recession almost

toppled multiple European countries, how would the United States handle a worse recession with much higher debt loads?

Democrats have made plans based on the false assumption that economic growth can reduce the deficit, while they continue to

craft policies to induce an economic crash.

Massive debt spending is often followed by a massive hangover, just as spending on social

initiatives, the Vietnam War, and the oil crises of the 1970s led to harmful stagflation. A combination of taxes, high

inflation, and unemployment sunk the economy before the reforms under Ronald Reagan.

Our public debt crisis has been partially obfuscated by outside factors such as economic growth and

budget gimmicks. However, as it grows, the options to handle it become fewer. The exploding Baby Boomer costs of

Social Security and Medicare will provide a stark choice between reducing benefits, cutting taxes, or both. Since the

Social Security trust fund is estimated to expire in a dozen years, all the Democratic proposals to expand expenses will only

hasten the day that Social Security checks are reduced.

Crushing debt is something that many Americans understand in their personal lives when it comes to

delaying plans, paralyzing action, and lowering standards of living. Whether we like it or not, we have contributed to the

same concept, millions of times over - in Washington. When a credit card bill comes due, an individual could declare

bankruptcy. When the government has its debt bill come due, all of us will be on the

hook.[5]

In mid-2023 the Congressional Budget Office (CBO) released its long-term fiscal projections the same

day that President Joe Biden began his economic rehabilitation tour.

In the words of The New York Times, Biden embarked upon “a concerted campaign . . .

to claim credit for an economic revival in America.” In a Chicago speech, the president touted his economic policies in

an address that aides called “a cornerstone speech of his presidency.”

On the same day, however, the CBO issued a more sober view of the nation’s economic trajectory —

a trajectory this administration has proudly accelerated.

“If current laws governing taxes and spending generally remained unchanged,” the analysis found,

“the federal budget deficit would increase significantly in relation to gross domestic product (GDP) over the next

30 years.”

What does that mean? “Such high and rising debt would have significant economic and financial

consequences,” the CBO concludes. “It would, among other things, slow economic growth, drive up interest payments to

foreign holders of U.S. debt, elevate the risk of a fiscal crisis, increase the likelihood of other adverse effects that

could occur more gradually, and make the nation’s fiscal position more vulnerable to an increase in interest rates.

In addition, it could cause lawmakers to feel more constrained in their policy choices.”

Within six years, the CBO projects, the national debt as a share of GDP will surpass the previous

record set during World War II. On our current course, the debt will exceed 180% of GDP in 2053. So much money will have

to go to paying interest on the bill, that it will squeeze out virtually all other priorities. That, in turn, will inhibit

private economic investment, creating further economic disruption.

To be sure, Republicans deserve plenty of blame for the national debt. But Biden has taken

particular glee in his massive spending proposals while devoting precious little time to examining the long-term

consequences.

It’s also worth noting that federal revenue in fiscal 2022 well exceeded average federal inlays

over the previous 30 years. Yet the rate at which spending outpaces tax collections continues to climb.

Washington has a spending problem which has metastasized to the point that our elected officials can no longer claim to

be blind to its presence.

In his Chicago speech, however, Biden made no mention of spending restraint or fiscal responsibility.

To the contrary, he continued to champion billions in more taxpayer giveaways, such as student loan forgiveness, and to

ignore the record-setting debt and inflation his policies have unleashed. Is it any wonder that American voters take such a

dim view of Bidenomics?[6]

------------------------------------------------------------------------------------------------------------------------

References:

- Mr. Creosote, Wikipedia, Accessed 14 March 2023.

- Joe Biden, Deficit Fighter? Think Again, Las Vegas Review-Journal, 12 March 2023.

- New Charts Reveal Harms of Biden’s Budget-Busting Binge, David Ditch, www.heritage.org,

8 June 2022.

- The Exploding Budget Deficit Is Another Big Problem for the Federal Reserve, Michael Maharrey,

schiffgold.com, 14 March 2023.

- How the $23 trillion debt crisis in America affects your own money, Kristin Tate, THE HILL,

23 February 2020.

- Budget agency pours ice water on Biden's parade, Boston herald; Pge 14,

8 July 2023.

| |